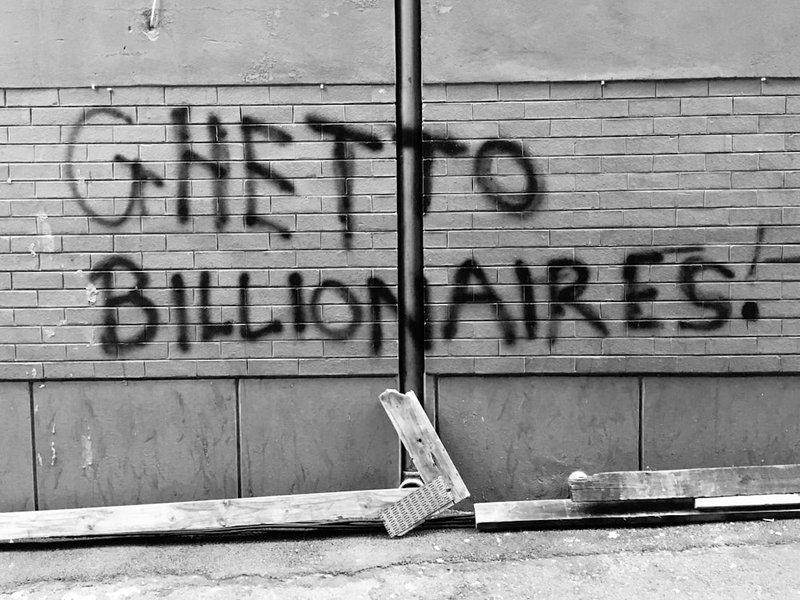

California's Bold Plan: Tax the Billionaires to Save Healthcare and Education

Photo by Hennie Stander on Unsplash

In a groundbreaking move that could reshape California’s fiscal landscape, labor and health care groups are pushing a radical ballot initiative that would impose a one-time 5% tax on the state’s billionaires. The proposed measure aims to generate approximately $100 billion in revenue to bolster healthcare systems and public education amid significant federal funding cuts.

Unions and community health organizations, including the Service Employees International Union-United Healthcare Workers West, are spearheading the initiative after facing deep federal cuts to social services. The proposed tax would target roughly 200 billionaires in California, with 90% of the revenue dedicated to healthcare spending and 10% allocated to K-12 education.

The backdrop for this initiative is stark: California is estimated to lose around $30 billion in federal Medicaid funds annually, potentially leaving 3.4 million people without health coverage. State lawmakers have already begun making difficult cuts, including partial enrollment freezes and reinstating asset tests for Medi-Cal.

Economics professor Emmanuel Saez from UC Berkeley supports the measure, emphasizing that the tax is structured to prevent billionaires from avoiding payment by relocating. The initiative would tax wealth established in 2025, with provisions preventing newly arrived billionaires from being subject to the levy.

Opponents, like the Howard Jarvis Taxpayers Association, argue that such a tax could create a dangerous precedent and potentially drive wealthy individuals out of the state. However, proponents maintain that the tax specifically targets ultra-wealthy individuals and would not impact middle-class residents.

With nearly 875,000 signatures required to place the initiative on the 2026 ballot, organizers are confident in their ability to move forward. The proposal represents a bold attempt to address systemic funding challenges and protect critical social services in an era of shrinking federal support.

As California continues to navigate complex fiscal challenges, this billionaire tax initiative could signal a transformative approach to funding public services and addressing economic inequality.

AUTHOR: kg

SOURCE: CalMatters