Health Insurance Costs Are About to Hit Bay Area Residents Hard in 2026

Photo by Ray ZHUANG on Unsplash

Bay Area residents brace for a significant health insurance price hike as Covered California announces a 10.3% premium increase for 2026. The double-digit rate surge represents the first such increase since 2018, driven by multiple complex factors that could leave thousands of Californians struggling to maintain health coverage.

The impending cost increase stems from a perfect storm of rising healthcare expenses and the potential expiration of federal subsidies implemented during the COVID-19 pandemic. These enhanced tax credits, which currently help over 90% of Affordable Care Act enrollees nationwide, are set to disappear at year’s end, potentially adding another 2% to insurance rates.

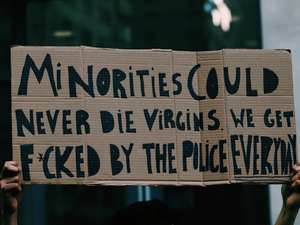

Health insurance agents like Ariana Brill are already warning consumers about the potential financial impact. “We’ll see rates go up. We’ll see assistance go down. And the net premium, the consumer’s take-home price, is going to go up considerably,” she explained. The consequences could be severe, with an estimated 600,000 people potentially dropping their health coverage due to increased costs.

State officials aren’t sitting idle. California plans to invest $190 million to maintain subsidies for low-income residents earning up to 150% of the federal poverty level. However, this investment falls far short of the $2.1 billion in federal subsidies the state stands to lose.

The broader implications extend beyond individual consumers. As younger and healthier individuals potentially opt out of coverage, the remaining insurance pool could become more expensive, creating a challenging cycle of rising premiums and reduced accessibility.

Factors contributing to the rate increase include aging populations, expensive pharmaceutical treatments, medical device costs, and ongoing economic inflation. Nationally, the median premium increase is projected at 18%, with subsidy loss accounting for approximately 4% of that surge.

As open enrollment approaches, Bay Area residents are advised to carefully review their healthcare options and prepare for potential financial adjustments. The future of affordable health insurance hangs in the balance, depending on potential congressional action to extend critical subsidies.

AUTHOR: kg

SOURCE: CalMatters