The Fine Print: Why Trump's "No Taxes on Tips" Isn't as Good as It Sounds

Photo by Blake Wisz on Unsplash

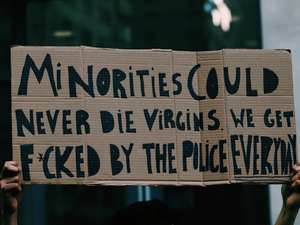

The promise of “no taxes on tips” might sound like a sweet deal for service workers, but the reality is far more complicated. Despite Donald Trump’s campaign pledge, the new tax policy comes with significant caveats that could leave many tipped employees feeling underwhelmed.

Under the recently passed legislation, workers can technically deduct up to $25,000 in tips from their taxes. However, the documentation required is extensive, and those earning over $150,000 annually are completely ineligible. The IRS has also introduced strict guidelines about what qualifies as a “voluntary” tip.

According to federal regulations, a truly voluntary tip must meet four specific criteria: it must be paid without compulsion, the customer must have complete discretion over the amount, it cannot be subject to negotiation, and the customer should determine who receives the payment. This means those mandatory service charges now common in Bay Area restaurants? They’re fully taxable.

Service charges for large parties or automatic gratuities do not qualify for the tax deduction. A Cupertino restaurant’s practice of adding mandatory tips even for single diners highlights how complex these new regulations can be.

The policy isn’t permanent, either. It’s set to expire in 2028, coinciding with the potential final year of Trump’s presidency. This temporary nature further undermines the initial excitement around “no taxes on tips”.

Unsurprisingly, many congressional members who crafted this legislation have likely never worked in service jobs, potentially explaining the policy’s nuanced and somewhat disconnected implementation.

For service workers hoping for significant tax relief, this policy represents more bureaucratic complexity than meaningful financial benefit. The devil, as always, is in the details.

AUTHOR: rjv

SOURCE: SFist