Stock Market Boom: Why Your Investments Might Be a Double-Edged Sword

Photo by Nick Chong on Unsplash

Americans are riding a stock market wave like never before, with household investments reaching unprecedented heights. Recent Federal Reserve data reveals that direct and indirect stock holdings now account for a staggering 45% of households’ financial assets in the second quarter of 2025.

While this might sound like cause for celebration, economic experts are sounding the alarm. The record-high stock ownership comes with potential risks, especially amid a fragile labor market and persistent inflation. The current market landscape is heavily dominated by tech giants, with the “Magnificent Seven” tech stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, driving nearly 41% of the S&P 500’s gains this year.

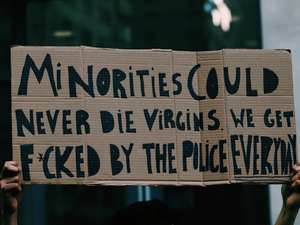

The surge isn’t just about numbers; it’s creating a stark economic divide. Wealthy Americans, whose wealth is primarily tied to stock market performance, are experiencing significant financial gains. In contrast, lower-income individuals relying on employment income are feeling increasingly constrained.

Top earners, defined as those making over $353,000 annually, now account for more than 49% of consumer spending, the highest share on record. This “K-shaped economy” phenomenon means the rich are getting richer while others struggle to keep up.

Financial strategists warn that this concentrated market structure makes the economy more vulnerable. A potential market downturn could have far-reaching consequences, potentially reducing consumer spending and affecting overall economic stability.

Investment experts like Rob Anderson from Ned Davis Research suggest investors should temper their expectations. “Investors shouldn’t expect the same magnitude of returns that we’ve seen during the last decade to repeat,” Anderson cautions, predicting a potential downshift in future returns.

As the stock market continues its AI-fueled rally, with the S&P 500 up 33% since its low point in April, investors and economists alike are watching closely. The current landscape offers both opportunities and potential pitfalls for the average investor.

AUTHOR: mei

SOURCE: CNN